Expanding End-Use Applications for Captured Carbon

Carbon Capture, Utilization and Storage (CCUS) and Direct Air Capture (DAC) technologies could offer powerful solutions for removing carbon dioxide from emissions sources and even the ambient atmosphere. But to enable CCUS and DAC to achieve their full potential and tap into the practically limitless supply of incoming and atmospheric carbon, we also need to think about demand for the captured product. Developing new end applications for captured CO2 can spur external demand pull forces that drive wide and profitable deployment of these technologies. Let’s invest in the research and development that will turn the carbon utilization space from niche to transformative, allowing carbon products to find specific market fit based on their characteristics and industry needs.

Direct air capture (DAC) of carbon dioxide and the related process of carbon capture, utilization, and storage (CCUS) present substantial opportunities for moving the world towards net zero emissions. Population growth and increased energy demand have solidified global greenhouse gas emissions on an upwards trend. Given this carbon-intensive course, technology that sucks CO2 out of thin air or prevents its release enables potentially powerful pathways for counteracting emissions.

Especially as energy usage is expected to continue to rise in coming decades, tools like DAC that help achieve negative emissions complement mitigation efforts in most scenarios for limiting global warming. As the CO2 concentration in Earth’s atmosphere soars past 400 parts per million for the first time in four million years, top climate experts are beginning to ring the alarm that quickly switching to a zero-carbon economy may not even be enough to prevent catastrophic effects of climate change. Today, as the U.S., China, India, and other large countries continue to build fossil-based power plants and as world citizens continue to buy more ICE vehicles, more carbon is destined to spend up to 200 years in our atmosphere. Achieving negative carbon emissions via tools like DAC is all but necessary in nearly every modeled scenario for maintaining Earth as we know it. For example, all Intergovernmental Panel on Climate Change (IPCC) pathways that keep warming below 1.5°C and 87 percent of pathways for 2°C rely on some level of atmospheric CO2 removal.

But in order for carbon capture to flourish in the fight against climate change, we need to transform the economics of DAC. Although the method is technologically feasible and future improvements promise to increase its efficiency, the cost of extracting CO2 from ambient air still hovers around a few hundred dollars per ton (though estimates vary). As such, barring massive government subsidies or a price on carbon that exceeds the cost of removal, DAC operators face severe economic pressure. Developing new end applications for captured CO2 is critical for creating the demand signals required to keep the market price for carbon (a) high enough to incentivize investments in expanding supply and (b) sustainable enough to make carbon capture widely feasible.

Carbon utilization is an emerging ecosystem full of big thinkers. Innovations that push the boundary on currently recognized gaseous, liquid, and especially solid end uses for CO2 will allow DAC and CCUS to reach their full potential. A strengthened commitment to R&D of specific carbon end applications will be critical for propelling widespread deployment of carbon capture.(In this article, we focus on end uses for solid carbon created from DAC, but many of the principles herein are applicable to CCUS.)

Science, Pricing, and Economics

Unfortunately, pulling carbon out of thin air is resource-intensive and costly. The two dominant mechanisms DAC plants use for capturing CO2 rely on either liquid solvents or solid sorbents: fans pull ambient air into an air contractor, where absorption columns(for liquid solvents like sodium hydroxide) or a filter (made with amines in the solid sorbent process) then initiate the separation process.

Widespread deployment of DAC will take time and innovation to achieve. According to the IEA, there were only 15 total DAC plants up and running in 2019 across the world. The challenge of separating carbon from air also requires a significant amount of energy, especially for the solid sorbent process — a 2019 studyestimated that capturing one ton of CO2 required between 0.6-1.8 GJ of electricity and 4.4-8.1 GJ of heat. And if a DAC plant is powered by solar or geothermal energy, space quickly becomes a key constraint: including its source of energy, a single facility might require between two and 25 square kilometers of space.

The input for the extraction process (air!) is free and accessible anytime, but removing CO2 at such low concentrations is costly. The earth’s atmosphere is 78 percent nitrogen, 21 percent oxygen, and only 0.04 percent CO2 (note how such a low concentration of carbon can have such a devastating effect on our climate!). Point-source CCUS removes CO2 at higher concentrations from flue gas, while DAC requires more energy to remove the same amount of carbon due to the gas’s sparse concentration in ambient air.

In the late 1950s, engineer Thomas Sherwood was pondering a similar relationship, and his Sherwood plot illustrates the inverse relationship between concentration and cost of extraction (less concentrated = more expensive). The same concept applies to DAC. Charting the minimum work required for CO2 capture against its concentration illustrates this principle.

Technological complexities, energy and space requirements, and lack of widespread market adoption result in high (yet quickly shifting) costs for capturing CO2. A 2011 analysis by the American Physical Society estimated the cost at $600/ton of CO2 removed, though companies involved in DAC also report that improvements to their processes are driving the cost of removal down: in 2018, Canada-based Carbon Engineering published a paper that estimated its costs between $94 and $232 per ton of CO2removed. Swiss company Climeworks is targeting a cost of $200-$300/ton within five years and $100/ton within a decade. Global Thermostat, meanwhile, thinks it can reach $50/ton. A federal Section 45Q tax credit also reduces the effective cost of capture — companies that sequestered CO2 in 2020 received a credit of $31.77/ton, while those that captured it for enhanced oil recovery (more on this later) or other uses received $20.22/ton. Those rates are set to increase to $50 and $35 per ton by 2026, respectively, for capture facilities that remove at least 100,000 tons of CO2annually.

Lower costs are an important part of making DAC viable for commercialization and scaling, but the demand side of the market still needs to mature to pull new carbon capture projects into existence. Some have attempted to crowdsource carbon capture and turn the act of removal into a service itself. Climeworks, for example, offers a tiered subscription service on its website where the company will remove CO2 in your name — from $8 a month for about 7 kg of CO2 removed each month up to $55 for 50 kg captured in the same time period. (You can also give CO2 removal as a gift). Other companies like Stripe, Shopify, and Audi pay Climeworks to remove CO2 as part of their climate commitments. But exclusively casting DAC as a market for personal and corporate carbon offsets will likely not inspire enough scaling for the technology to contribute negative emissions on a large scale. DAC companies and CCUS operators should be incentivized to sell what is essentially a byproduct of their service as a raw material — i.e. CO2.

Carbontech Solutions

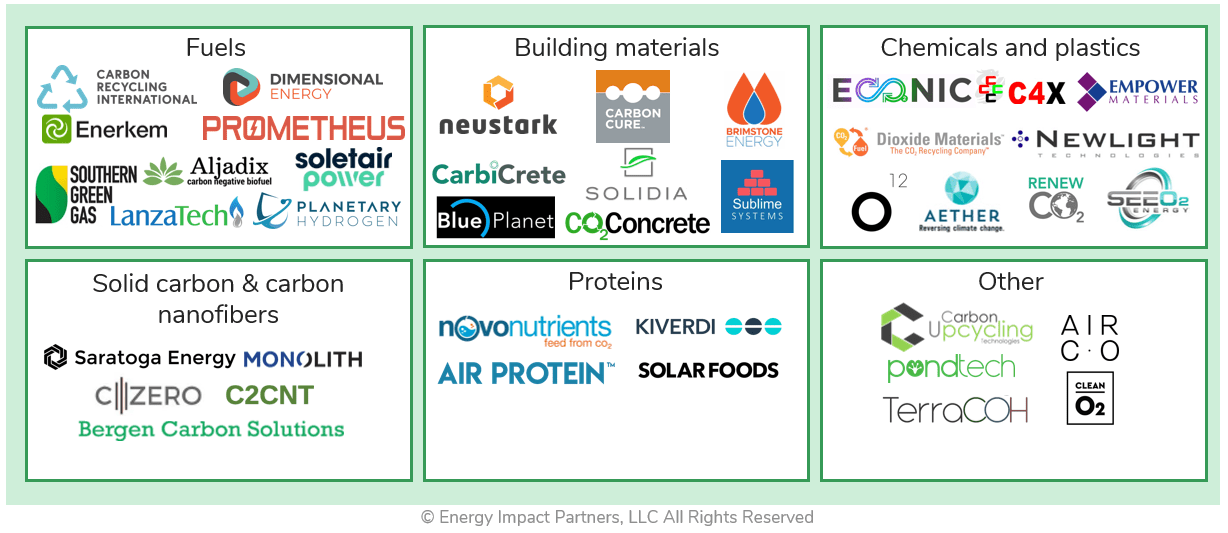

Even though DAC’s scaling journey is just beginning, several carbon utilization startups are already operating in a landscape coined “carbontech.” Most currently use carbon captured at point source from the flue gas of factories and production facilities, and only some companies have fully commercialized their products — but even if carbon-based products are not underpricing market incumbents, companies and government agencies hoping to source carbon-negative goods have an important role as anchor customers. In spring 2021, a bipartisan group of legislators re-introduced the “Storing CO2 and Lowering Emissions Act” (AKA the SCALE Act) for funding transport and storage infrastructure to support carbon capture and use. Notably, the bill would also set aside funding for the Secretary of Energy to provide grants to state and local governments for the procurement of carbontech or carbon-negative products.

Gas and Liquid Solutions

The most developed uses for CO2 are primarily gaseous. Of the 230 total million metric tons (MMT) of CO2 utilized each year, urea production by the fertilizer industry uses 130 MMT, according to the IEA. Soil and leaf fertilization accounts for 90 percent of urea’s total use, meaning more than half of all CO2 end application occurs in the agricultural industry. Enhanced oil recovery (EOR), where captured CO2 is pumped back into oil and gas reservoirs to increase yield, annually uses another 70 to 80 MMT, leaving only about 10 percent of global CO2 capture for other applications. The IEA estimates global demand for CO2 is rising at a mere 1.7 percent year-on-year — so to accelerate the adoption of DAC and CCUS, perhaps we should strive to significantly expand the 10% of current CO2 demand not devoted to urea or EOR.

Other gaseous and liquid end uses for CO2 have not yet reached the scale of EOR, but have the potential to enhance synthetic fuel development, support indoor farming, and offer new consumer-facing goods in niche markets. Zero-carbon fuels would turn what is currently a linear energy system into a circular one: instead of harvesting fossil fuels from the ground and depositing them in the atmosphere, zero-carbon methane made by combining CO2 and H2 would release previously captured carbon upon re-combustion.

The potential market size for CO2-based fuels is significant — aviation fuels represent an area where few low-carbon alternatives exist — but the cost of producing hydrogen, the most likely candidate, at a sufficient density for things like aviation remains an obstacle. Other liquid and gaseous uses are already active at a limited scale:

Luxury-focused Air Company developed technology that can turn CO2 into ethanol — they boosted production of hand sanitizers when the pandemic first locked down the U.S. last spring, and a bottle of their carbon-negative vodka sells for about $70 online.

In farming, imported CO2 can support increased yields in greenhouses and indoor facilities.

And in non-alcoholic beverages, Swiss Coca-Cola subsidiary Valser uses CO2 captured by Climeworks, which has also sold CO2 to greenhouses, for carbonation.

Source: Energy Impact Partners via Climate Tech VC

Solid Solutions

Gaseous uses of CO2 like urea and EOR may be most mature at the moment, but applications for solid carbon could theoretically represent more effective vessels for reducing atmospheric CO2 in the long term. Solid uses can sequester carbon for longer than most gaseous and liquid solutions: fuels might temporarily store carbon for a year, but CO2 added to solid industrial and building materials might be trapped for millions of years. Pursuing all options is important right now given the urgency of the problem, but in the long run, carbon-negative uses are more beneficial than carbon-neutral ones. For either case, more urgent R&D efforts focused on solid carbon integration from companies selling any sort of manufactured goods will reveal carbon’s highest-value end applications.

So what is solid carbon? It is one of the most abundant non-metallic elements on earth and forms more known compoundsthan all other elements combined. Solid carbon’s properties vary with the form it takes: graphite is dark, soft, and a good conductor, while carbon’s other allotrope diamond is extremely hard, transparent, and a poor conductor. CO2 (rightfully) gives the element a bad reputation in climate circles, but increasing our focus on carbon black used in rubber, strong and light carbon fibers, the large surface area of activated carbon, the conductivity of graphite, and other carbon-based compounds on a nanoscale can illuminate clever new uses for the element.

CO2 should be repurposed into a solid raw material, but that doesn’t equate carbon to a commodity. Solid carbon isn’t an interchangeable one-trick pony like corn or soybeans; applications for solid carbon are too nuanced for the element as a whole to become commoditized. Instead, we should expect unique supply and demand forces to interact in every micro-market for variations of solid carbon. Clear market winners may emerge due to differences in carbon grade and performance, and considering where a particular type of solid carbon excels is critical for determining its specific use.

For example, Saratoga Energy uses a molten carbonate electrolysis process to convert CO2 into high-value carbon nanotubes. The company first experimented with synthetic graphite before winning a 2018 grant from the National Science Foundation to scale up its production of carbon nanotubes that are 100 times longer than a normal carbon nanotube. Having raised a seed round and gone through Y Combinator, the company is now fundraising for a demonstration-scale facility and eying end applications for its specific type of nanotube in tires, where they are expected to improve wear resistance, grip, and rolling resistance; batteries, where carbon nanotubes could deliver strong cycling performance and enable higher energy density; and cement, where the addition of nanotubes could increase strength and decrease the amount of carbon-intensive raw cement used per unit of volume.

Other startups are working on similar solid nanomaterials made from CO2. C2CNT also draws on captured CO2 to produce carbon nanotubes, carbon nano-onions, graphene, and other solid structural materials. In Norway, Bergen Carbon Solutions started production at a test facility last year and are now upscaling at a new product facility, where they plan on producing strong, conductive carbon nanofibers for applications in batteries, supercapacitors, and solar desalinations.

Such interest expands to companies utilizing CO2 for chemicals and polymers. Twelve, which recently rebranded from Opus 12 and raised $57 million in a Series A funding round, takes CO2 from sources of emissions and uses an electrolyzer in a modular unit at the site to turn the gas into chemicals. They partnered with Mercedes-Benz last year to create the world’s first CO2-made car part and also envision a carbon-derived consumer line of things like Twelve-branded sneakers and sunglasses.

Solid applications for CO2 also have the potential to deliver emissions reductions in industries or processes that are otherwise very hard to decarbonize. Companies like Neustark have found that storing captured CO2 in concrete brings down the use of cement per unit (therefore reducing the number of times that chemical reactions need to occur), while CarbiCrete is curing cement-free concrete with CO2, which turns into calcium carbonates and gives the material strength. (Production of cement, which accounts for about 8% of global CO2 emissions alone, involves a chemical reaction that turns limestone (CaCO3) into lime (CaO) and CO2, meaning new fuels for heat or improvements to energy efficiency don’t eliminate emissions from the chemical reaction.)

Despite these promising developments, the unfortunate reality is that commercialization and scaling for solid carbon applications remains difficult. Potential end markets exist — batteries, tires, aerospace, even sporting goods — but finding the right product-market fit between solid carbon producers and specific end applications remains a challenge. For example, C-Zero, which uses a form of methane pyrolysis to convert natural gas into hydrogen and dense solid carbon, simply plans to sequester the carbon it generates underground. The company is focusing on the hydrogen production aspect of its process, choosing to (at least temporarily) ignore the potential value its solid carbon byproduct could provide, ostensibly because there is currently no clear buyer for the solid carbon it creates. To create a truly sustainable future for DAC — and to support other carbon-negative processes — C-Zero needs a buyer for its carbon, and sequestration of solid carbon should not remain the default option.

Merging Innovations with End Applications

Academic research often helps ignite the process of matching solid carbon products to specific applications. Materials research can highlight scientific principles that suggest where uses of carbon materials could improve performance, and applied laboratories then put those theories to the test. To support innovators in the space, we should work to increase the number of labs, organizations, or companies that test the viability of specific solid carbon solutions on a small scale. Multiplying the number of applied carbon research labs, such as the University of Sydney’s Advanced Carbon Research Lab, Rice University’s Carbon Hub or the Oak Ridge National Laboratory’s Carbon Fiber Technology Facility, is a major first step towards improving the process for matching and testing grades of solid carbon for blends and end uses.

More opportunities for market testing and deployment will ultimately allow captured CO2 products to support specific end applications with optimal fit. Let’s invest in the research and development that will turn the carbon utilization space from niche to heavyweight, moving us to complement CO2-derived vodka and carbon capture sparkling water with applications that upgrade entire industries, undercut incumbent technologies, and keep CO2out of the atmosphere for good.

Creative uses of CO2 and solid carbon are technologically feasible, but overcoming commercial hurdles presents the next challenge for scaling these technologies. ADL has deep experience providing the scaffolding hard tech startups need to grow, and we’re eager to assist with this new hurdle. If you’re a carbon tech startup looking to achieve new scale, reach out below.