Methane Monitoring: Deploying Innovations to Detect Fugitive Emissions

Author: William McCormack and Ben Silton

Methane seeps into the atmosphere from leaks along the natural gas chain, and reducing these fugitive emissions represents one of the least costly solutions for limiting greenhouse gases in the short term. Each cubic foot of leaked gas constitutes wasted value from fixed assets failing to serve consumers. Federal regulations for methane emissions are evolving, and innovators are developing creative new tools for efficient, comprehensive monitoring of natural gas leaks; the challenge now lies with facilitating their deployment.

In discussions around renewable energy and the transition away from fossil fuels and greenhouse gases (GHGs), language around carbon cloaks the conversation. Crucial goals over the next few decades include ongoing decarbonization, the development of a low-carbon economy, carbon neutrality, and zero-carbon processes. The emphasis on reducing and removing CO2 emissions is well-placed: the gas accounts for more than three-quarters of global emissions and remains in the stratosphere for hundreds of years.

But these carbon-centric terms ignore a big opportunity to minimize the climate impact caused by carbon dioxide’s powerful GHG accomplice: methane (CH4), the carbon-based gas constituting about 95% of natural gas.

Although methane only comprises about 10% of annual greenhouse gas emissions volume in the U.S., its atmospheric concentration has grown rapidly since the 1980s and especially over the last decade, when fracking for shale gas largely drove a surge in production. Its influence on the climate is significant. Methane’s global warming potential (GWP) — a measure of how much warming one ton of gas emissions will cause relative to one ton of CO2 emissions — is 84-87 over a 20-year time horizon. That figure suggests methane emissions are 80 times more potent than carbon in the short term. Methane only lasts in the atmosphere for about a decade, which tempers its impact in the long run and lowers the estimate for its 100-year GWP to 28-36 (remember this distinction the next time you see the two gases compared!).

According to a 173-page United Nations report on methane published in May 2021, a 40-45% reduction in CH4 emissions by 2030 will facilitate one of the least costly pathways to avoiding the 1.5 ℃ warming target set by the Paris Agreement.

So where do we start? Methane leaks. In the oil and gas sector, natural gas seeps into the atmosphere via three main sources:

Vented emissions intentionally released by equipment for safety reasons or operational requirements

Incomplete flaring emissions discharged during the burning of natural gas when it cannot be used or recovered

Fugitive emissions that unintentionally escape from leaks or faults throughout the gas chain. Regardless of the reason for leaked gas, every cubic foot represents a net loss in value that is ultimately passed on to downstream customers in the form of more expensive energy.

Deploying innovations that help identify, detect and actively monitor methane leaks will be key to eliminating fugitive emissions. Tools for methane monitoring are emerging, but their adoption by oil and gas companies of all sizes must occur at a rapid speed for companies, customers, and the atmosphere to see results.

Benefits of Monitoring and Patching Leaks

In North America, the oil and gas sector presents the largest opportunity for methane emissions mitigation. The UN report estimates that up to 80 percent of methane reduction measures in the industry could be achieved at negative or low cost.

Innovators helping to plug methane leaks can take advantage of the fact that methane leaks are inherently counterproductive for oil and gas companies. Unlike some other pollutants or emissions, methane has absolute commercial value. Each cubic foot of gas leaked into the atmosphere represents lost value from fixed assets not flowing to consumers. Methane leaks make remaining gas more expensive for consumers downstream, while companies lose the opportunity to sell additional commodities generated by fixed natural gas infrastructure. The economic incentive to reduce methane emissions varies with natural gas prices, but is never zero.

Interestingly, oil and gas companies have mixed feelings on tackling this issue. When the Trump administration relaxed regulations around methane emissions — one EPA rule eliminated a requirement that companies install technology to detect and patch leaks — several big producers, including BP, Shell, and ExxonMobil, issued statements in favor of more stringent methane rules. Some have suggested that the companies’ support for Obama-era restrictions is because runaway methane leaks might compromise popular opinion of natural gas as a clean bridge fuel, while other analyses have pointed out that big oil and gas companies can manage methane leaks with proportionally lighter costs when compared to smaller competitors. Others in the industry, including the American Petroleum Institute, altogether supported the regulatory rollback.

In April 2021, however, the U.S. Senate reinstated Obama-era methane emissions standards, forcing all companies to comply. Biden’s EPA plans to announce even stronger methane rules in September.

Quantifying the Problem

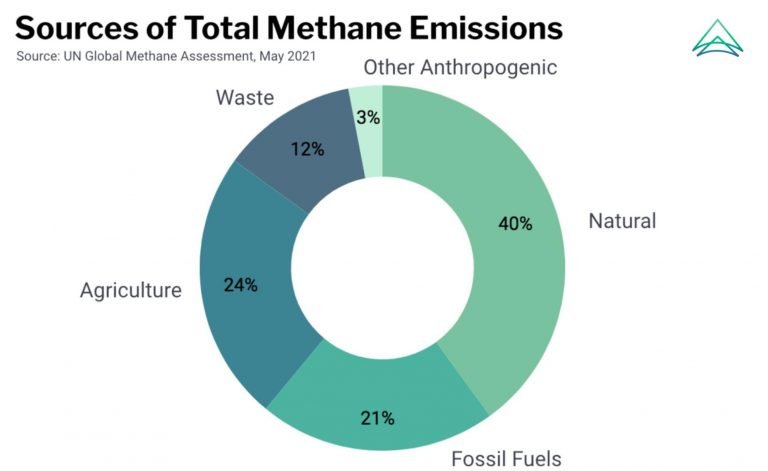

Before we preview solutions, let’s take a closer look at methane emissions today. Globally, anthropogenic emissions account for 60 percent of annual methane emissions (the remainder occur naturally from wetlands or freshwaters). Of that amount, 40% originate from agricultural sources (mainly livestock and rice cultivation), 35% from fossil fuels (about two-thirds of which come from oil and gas), and 20% from waste (landfills and wastewater). According to IEA estimates, the U.S. oil and gas sectors emitted around 11.8 million metric tons of methane in 2020, with 7.9 million metric tons originating from the natural gas industry.

Although 7.9 million metric tons of methane pale in comparison to the 1,646 million metric tons of energy-related CO2 emitted by the natural gas industry alone in 2020, the gases’ disproportionate influences on the climate require sharp reductions in methane emissions. With projections like the IEA’s Sustainable Development Scenario requiring a 70% reduction in oil and gas sector methane emissions between 2020 and 2030, leak detection and repair will need to be widespread.

But exactly how much methane from fugitive emissions enters the atmosphere each year remains a murky question. Because natural gas is invisible to the naked eye, and since odorants are not added until the gas reaches the distribution grid, fugitive emissions are difficult to locate and repair. Recent studies have led to a growing scientific consensus that actual emissions over the past decade are substantially higher than EPA estimates — another reason to prioritize the use of emerging technologies to track leaks.

Where is methane leaking from?

Methane leaks occur all across the natural gas chain — some “super-emitters” spew gas into the atmosphere at certain sites, while smaller leaks occur in pieces of equipment across upstream (production, gathering, processing) and downstream (refining, transmission, and distribution) segments.

Innovative Tools

Traditionally, oil and gas companies have relied on leak detection and repair (LDAR) programs for identifying and plugging methane leaks. While consistent LDAR surveys have been shown to reduce fugitive emissions, the process is often time-, resource-, and labor-intensive. Following the EPA’s Method 21 procedure, a surveyor typically uses a probe to physically inspect, touch, and document each component’s leak interface for all pieces of equipment. Method 21 LDAR surveys are more cost-effective for upstream operations but do not always suit the inspection of equipment downstream — checking transmission pipelines takes longer (and requires a whole lot of leg stamina from surveyors) when compared to production equipment concentrated in one facility or area. Along distribution and transmission pipelines, we need to use machines and aerial technology to allow for efficient, frequent monitoring.

Methane-monitoring startups with emerging technologies have the timely opportunity to capture the winds of strengthened federal regulations. Innovators are responding to the need to move beyond traditional M21 LDAR surveys with solutions for fugitive emissions detection that are less time-consuming and more comprehensive:

TrelliSense has developed innovative ground-based, continuous monitoring sensors for point and area emissions sources. Their optical sensors use the sun as a light source to essentially act as a methane radar scanning the sky above assets such as natural gas processing/storage facilities, landfills, metering/regulation stations, dairy farms, oil fields — even entire cities. Not only are they much more sensitive than satellites, but because they collect data continuously they are able to characterize the emissions behavior at a given site (rather than simply take point-in-time estimates). Interestingly, TrelliSense’s optical technology is translatable to other gaseous emissions, offering additional value streams to many facility types.

Diagram of TrelliSense’s sensor configurations. (Source)

Sources: Results from the Stanford/Environmental Defense Fund Mobile Monitoring Challenge; National Association of Regulatory Utility Commissioners; Author Search

Facilities like the Methane Emissions Technology Evaluation Center (METEC), a site near Fort Collins, CO funded by the DOE’s ARPA-E program, continue to stage experiments with controlled releases of methane to test new technologies like the ones above. The site recently hosted a “Mobile Monitoring Challenge” sponsored by Stanford and the Environmental Defense Fund. Eight of the nine technologies tested correctly identified 75% of actual leaks, but the report also concluded that tools generally struggled to accurately quantify the size of leaks/the leak rate.

Gaps and Opportunities

Detecting and monitoring methane leaks represent key steps towards decreasing emissions and cost-effectively improving efficiency along the natural gas production line. Proper identification and measurement of the problem is a prerequisite for any solution. The return of more formidable federal methane policies will require oil and gas companies to further adopt instruments for identifying leaks, and the technologies described above should help them fight that battle.

Plugging methane leaks will also require continued improvements in methane monitoring technology to fill key gaps in current tools. Sensors and drone-based solutions that are immune to changing environmental conditions like wind and rain would improve the viability of aerial devices, while more precise quantification abilities would help methane monitors better report the size and specific location of leaks. We also need improvements to algorithms that translate raw identification data into clear steps companies and equipment operators can take to stop leaks. Finally, we should ensure surveys to monitor methane emissions are continuous or nearly so — reducing the per-use labor requirements for each tool would facilitate faster survey times and more frequent sweeps for leaks.

As innovative methods continue to develop and reach the market, the challenge now lies with facilitating their deployment. If you’re working on an improved tool for leak detection and repair, or if you’re a legacy-sector firm seeking to drive down costs and methane emissions, reach out to us below to see how ADL can help.