A Resurgence in Domestic Solar Manufacturing Drives New Funding Opportunities for Emerging Market Players

$27M PV Incubator Funding Opportunity Headlines Key Innovation Opportunities; ADL Continues to Support Multiple DOE / NREL Initiatives

With geopolitical tensions causing oil and natural gas to face extreme supply shocks as well as rise to record high prices, the need for cheaper, cleaner renewable energy fully produced in the US takes on heightened importance. ADL Ventures’ team includes some key manufacturing and project development innovators from the solar industry, and we are proud to be assisting the Department of Energy Solar Technologies’ Office in the recruitment and mentoring of the next generation of solar innovators in realizing this unique generational opportunity. Don’t hesitate to contact us if you are actively working on or considering developing solar technology related to any of the initiatives listed below.

Background

The solar industry is the largest source of new power generation in the US. Its growth has been rapid and addressed significant environmental, siting and transmission & distribution challenges associated with fossil fuel based power plants. In 2021, 46% of new electric capacity that was added to the grid came from solar. This share of energy expenditure was the largest in history for solar, and the third year in a row that the most generating capacity added has come from solar technology. The decrease in cost, increase in capacity, and continuing innovation has allowed solar to increase its competitive value proposition when compared to other renewable energy sources.

Overall, in the last decade, there has been an average annual growth rate of 33% for solar installations. This can be attributed to rapidly decreasing costs, an increase in demand throughout both the private and public sectors for clean electricity, and some supportive federal policies such as the investment tax credit as well as the newly released Inflation Reduction Act. Between the years 2010 and 2020, the price for solar PPAs nationwide was cut in half from $100 / MWH to $50 / MWH. Those gains have stagnated in the last two years, however, with labor and materials inflation, as well as the industry’s dependency on foreign components, whose availability and pricing have become more problematic during the COVID-19 pandemic.

Fig 1. The graph is showing the increase of solar installation in the United States in the last decade

Now more than ever, there is a glaring need for further solar manufacturing and innovation onshore. China is the runaway leader in solar manufacturing, with over 80% of global photovoltaic manufacturing output. The increasing lead times and rising costs of shipping, as well as energy independence and energy security concerns, make the economic and geopolitical costs of imported solar panels dramatically higher than before. The cost of shipping a 40 foot container from China to west coast US ports have hovered around $15,000 throughout 2022, roughly 10x the price at the outset of 2020. New innovations in the U.S. are re-emerging to keep up with the demand for affordable solar energy, and are poised to increase the amount of domestic renewable energy production powered fully by US suppliers.

Solar Technology Landscape

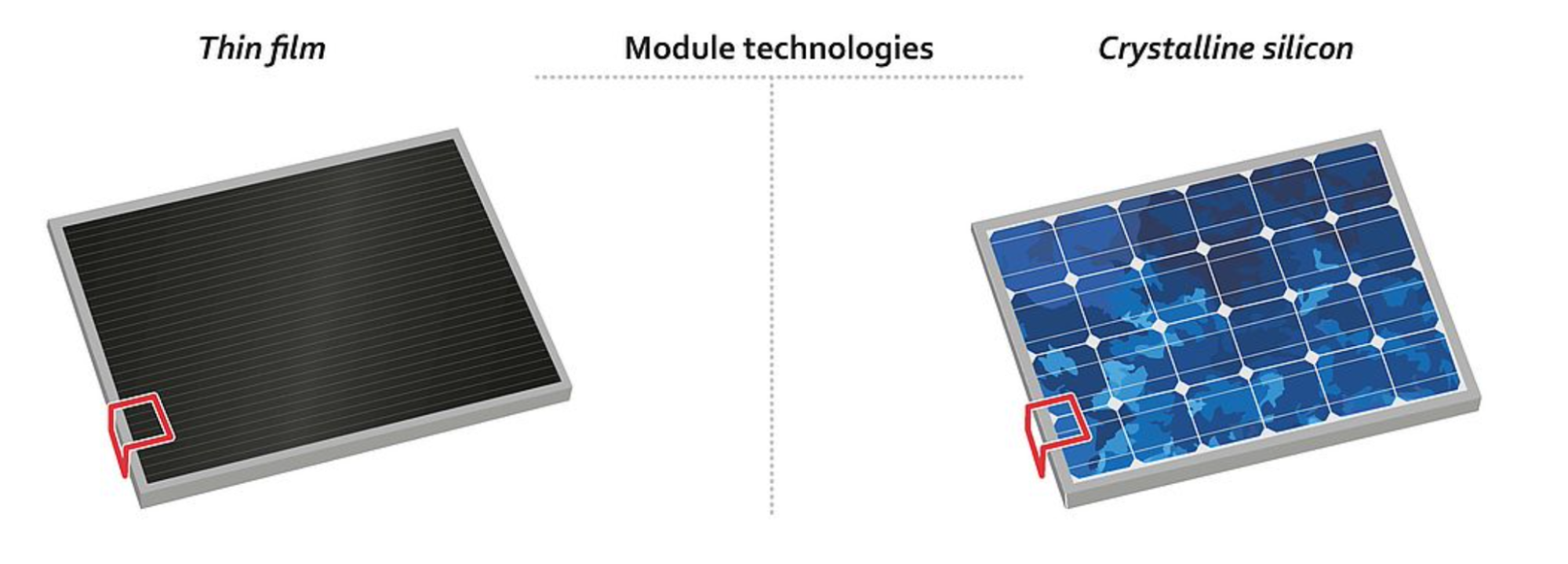

Solar cell & module technology, which comprises about 50% of the cost of a typical solar installation, is made up of an assortment of different materials that vary in size, efficiency, and price. Monocrystalline silicon panels are the most common type of panel used in commercial and residential distributed generation projects because of the high level of efficiency along with low mass production costs. Monocrystalline solar panels, along with polycrystalline silicon panels, dominate the market with 73.3% market share. Panels based on thin-film technology which utilize significantly less semiconductor material have long offered the promise of lower costs, but most have been unable to reach viable cost and scale given the dominance of Chinese silicon manufacturing, with plants in China often being 100’s to 1000’s of times larger than their US counterparts.

Recently, a number of new cell and module technologies which have undergone significant research and development over the years has begun to hit the market at larger scale, including Passivated Emitter and Rear Cell (PERC) panels, Copper Indium Gallium Selenide (CIGS) thin-film panels, and Cadmium Telluride (CdTe) thin-film panels. The past five years have also seen increasing investment in the development of high-efficiency perovskite thin-film technologies which can either work on a standalone basis or be integrated with silicon as part of tandem junction cells.

Fig 2. This image is showcasing the difference between thin film, monocrystalline, and polycrystalline solar panels

Fig 3. This image is showcasing the difference between thin film and crystalline silicon solar panels

Cadmium Telluride Has Emerged as Key Alternative to Silicon

CdTe panels, manufactured primarily by the highly successful US panel manufacturer and project developer First Solar, have been far and away the most successful example of the development and deployment for thin-film solar technologies. These panels are the second most common PV technology in the global marketplace, following crystalline silicon panels, with ~5% market share. CdTe can be manufactured as a fully integrated module, similar to the automated processes used for LCD TV manufacturing, and recent improvements in CdTe have matched the cost/performance ratio of multi-crystalline silicon.

Cadmium Telluride panels have been in research and development for nearly 30 years, with the last decade and a half showing particularly impressive improvement in efficiency and cost reduction. Some of this work resulted from the partnership between the National Renewable Energy Lab (NREL) and First Solar, dating back to the early 90’s. At module efficiencies of 16-18% (a >100% performance improvement from when First Solar did its IPO in 2007), CdTe panels are not quite as efficient as traditional crystalline panels, but their lower fully delivered cost in the US market, along with an efficient project development channel, has allowed for the technology to seize 40% of the U.S. utility-scale PV market.

First Solar Annual Revenue, 2018-2021

Source: Yahoo Finance

First Solar has recently announced plans to further scale up domestic production, investing $1.2B to increase capacity by 4.4 gigawatts per year, while adding 850 jobs. Once this expansion is complete, its domestic manufacturing capacity will exceed10 GW per year by 2025. The various ancillary co-development and supply chain opportunities that could be created by this expansion, along with the reality that FSLR is such a unique success story that it does not yet have a reliable “second source” supplier in CdTe, creates significant opportunities for other CdTe-related technologies to enter the market.

Many of the developments of new technologies across the energy sector are supported by federal grants and research opportunities that are available for application, such as the DOE Solar Technologies’ Office’s (SETO) PV Incubator program. Furthermore, the various market-based incentives and tax credits in the newly introduced Inflation Reduction Act brings American manufacturers closer to parity with Chinese and other Asian producers that have leveraged decades worth of state incentives and other non-market competitive mechanisms including forced labor.

$370B IRA Provides Unprecedented Support for Both Deployment and Manufacturing

The Inflation Reduction Act, passed by the U.S. senate on August 7th 2022, is a $370B bill aiming to address climate change and health in the United States. The investment is geared towards an increase in domestic energy production and manufacturing, with the overall goal to achieve reduction of carbon emissions by roughly 40 percent by 2030.

The bill allocates $30B in production-based tax credits for solar panels, along with wind turbines, batteries, and critical minerals processing. This bill also includes a 10 year extension of the up to 30% tax credit received for installing residential solar panels.

For the first time in US history, >50% of the cost of a solar installation could be covered by tax credits, if they meet a variety of domestic labor/manufacturing, environmental justice, and socioeconomic equity criteria, including:

Projects more than 1MWac: in order to be eligible for the full 30% tax credit, the employees that are working to install the solar projects need to be paid prevailing wages and also be involved in an electrical apprenticeship program

Projects using hardware that is produced domestically: qualify for an additional 10% tax credit

Projects that have manufacturing locations based in communities that have been relient on the fossil fuel industry for employment: qualify for an additional 10% tax credit

Projects that target sales to low-income communities: qualify for an additional 10% tax credit

Credits will be applied to various components as either a set amount per watt, or a set amount per production quantity. Doing so will allow for the government to reward actual deployment and performance. These first-of-their-kind tax credits related to the manufacturing of domestic solar components are currently expected to be as follows:

Abigail Ros Hopper, president, and CEO of SEIA said in a statement regarding the passage of the act, “The solar industry has set a goal to account for 30% of all U.S. electricity generation by 2030, and this legislation will be a catalyst for reaching that target. Now the work can begin to build out America’s clean energy economy with historic deployment, domestic manufacturing, investments in low-income communities, energy storage, smoother interconnection and so much more.”

In addition, other supplemental funding for R&D such as collaborative awards/grants, and various other prizes and challenges, create a huge range of smaller-scale innovation opportunities for game-changing technologies. For instance, the American-Made Challenge: Perovskite Startup Prize, issued by the U.S. Department of Energy Solar Energy Technologies Office is a two-stage, $3 million competition that was developed to improve and accelerate the innovation and domestic manufacturing of perovskite solar cells.

Solar Energy Technologies Office: SETO Incubator Program

An assortment of other programs are offered through SETO and NREL including The American-Made Solar Prize, Small Business Innovation Research, Small Business Technology Transfer, Technology Commercialization Fund. Perhaps none has had the impact and scale of the PV Incubator Program, now entering its 11th funding cycle, which helps address the critical gap between proof of concept and demonstration-scale prototypes. Successful past recipients include CubicPV, which closed a $25M investment round and merger last year, and Aurora Solar, which has raised over $500M in funding to date. ADL Ventures is proud to be supporting the recruitment and mentoring of applicants for the first time, after successfully supporting more than 30 successful applicants for recent rounds of the American Made Solar Prize, as well as American-Made Perovskite Start-up Prize Countdown Contest winners such as Beyond Silicon, Verde Technologies, SoFab Functional Inks and others.

In this latest round, diverse entities of all types are encouraged to apply and build strong teams with multiple partners from across the country and throughout the solar value chain, and a new second topic area has been added which covers projects specifically related to the pilot deployment of existing cadmium telluride PV technologies. The full Funding Opportunity Announcement can be found here. If you are interested in applying for the SETO Incubator program, the American-Made Perovskite Start-up Prize, or are otherwise interested in exploring growth opportunities for your US-based solar business, reach out to ADL Ventures today!