R&D Prioritization and Commercialization

The Goal

Analyze and prioritize the R&D portfolio projects funded by a major US energy utility, and support the commercialization of the most strategically valuable and technically feasible project(s).

ADL was recruited to assess the commercial viability and value of an early R&D portfolio funded by the Corporate Strategy group of a major US electric/gas utility. All eight research projects under consideration, each of which ventured to solve a unique problem in the energy sector, had yet to leave an academic lab. ADL conducted a rigorous techno-economic analysis of the technologies and the problems they ventured to solve, considering the likelihood of success along with potential impact. Through a multi-stage down-selection process, ADL identified one winning project and led the utility through the incorporation of a startup, writing a founding term sheet, negotiating a license from the research university, recruiting a founding CEO and successfully raising $7M across multiple non-dilutive grants to further advance the core research.

ADL’s Approach

ADL Ventures was approached by a major US energy utility that, over the previous five years, had invested in a portfolio of early research projects to generate strategic value for the business. Before engaging ADL, the utility faced uncertainty regarding its strategic support for eight of those research projects and was weighing its options for continuing support of those initiatives.

ADL assembled a technical and entrepreneurial team and performed rigorous market analyses for all relevant downstream markets for each of the eight technologies, including top-down market sizing and bottom-up market adoption expectations, to assess the value potential of each project. We further coupled this with feasibility studies based on in-depth technical deep dives into the core lab technologies and interviews with target customers and partners to understand the technical performance risks and strategic customer adoption risks.

Finally, ADL evaluated all projects based on a weighted summation of value and feasibility, per the methodology below:

Downselection and Diligence

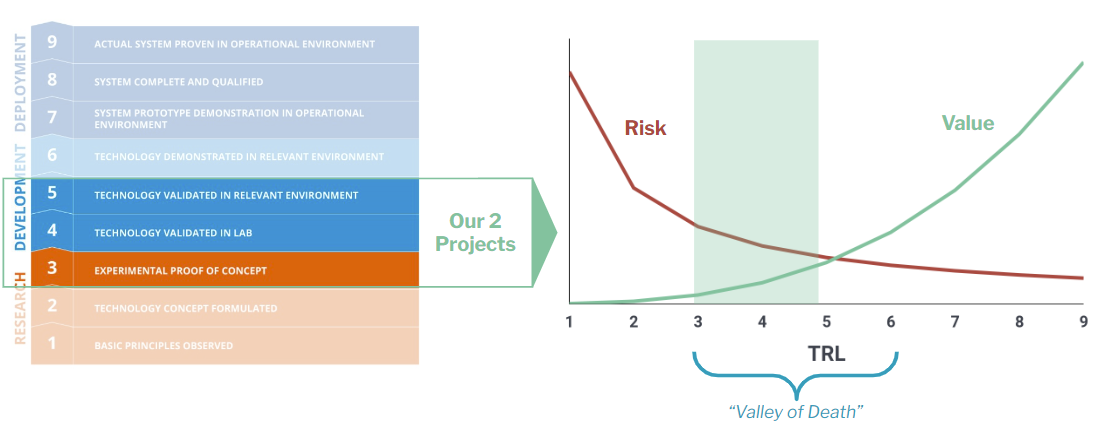

Based on these results and other inherent strategic factors, ADL and our client narrowed our focus to two projects for further assessment of near- and medium-term feasibility. Specifically, our near-term strategy focused on de-risking each technology by pursuing avenues for in-situ demonstration of each technology in a relevant environment, per the Technology Readiness Level scale described below:

In pursuit of early commercialization, ADL shifted its focus to five main workstreams:

Relationship development with future customers and commercialization partners

Domain expert recruitment for startup founding teams and advisors

Formal business plan development, including monetization strategy

Financing structure analysis and strategy, including preliminary valuations via DCF and comparables analysis

IP development and transfer support, including license negotiations

Results and Commercialization

At ADL’s suggestion, one project – related to hydrogen-proofing gas infrastructure – was ultimately approved for commercialization, and ADL continued to work on the commercialization effort in exchange solely for equity in the forthcoming startup instead of direct fees.

On the commercialization path, ADL developed an equity allocation structure for the startup and wrote the founding term sheet for the now-stealth startup. Our team supported the negotiation of the IP license from the university technology licensing office, and in parallel recruited a founding technical CEO. With the founding CEO in place, ADL sourced grant opportunities and co-wrote grant applications which led to two non-dilutive grants to continue research, totaling $7M, awarded in the summer of 2022. These successful grant applications validate our vision for this technology, and ADL continues to advise the founding CEO of this stealth startup.