The Role of RNG in Tomorrow’s Gas Economy

Authors: Selma Sharaf and Ben Silton

Punch Line #1: If we want to serve all of today’s US natural gas demand with renewable natural gas (RNG), at least 80% of it will have to be produced using renewable electricity as the feedstock. Continue reading to learn more about the why and the how!

Renewable natural gas (RNG) has long crept around the fringes of the American energy economy, but in 2022 finds itself in a bright spotlight at the confluence of major economic, environmental and geopolitical conversations across the world. One contributing factor has been the Russian invasion of Ukraine, which has raised concerns about foreign imports of Russian oil and gas, “fueling” Russia’s ability to finance their military efforts. Meanwhile, a coincident supply crunch has raised gas prices to a 14-year high, affecting bills for the roughly half of Americans who rely on gas for home space and water heating. Finally, America’s gas industry continues to ramp up its focus on promoting methods of decarbonizing their operations, expecting RNG alone to account for roughly 25-40% of total emissions reductions across the sector by 2050.

Like other renewable energy sources, RNG requires specialized technology and financing for distributed infrastructure deployments, and more importantly the associated cooperation among all stakeholder communities including developers, plant operators, utilities, investors, policymakers, feedstock providers and even consumers. In this post, we explore America’s RNG potential and what gaps remain in turning RNG into America’s leading gaseous fuel.

What is RNG and how is it produced?

RNG, also known as biomethane, is produced from renewable sources and is interchangeable with fossil gas. There are two overarching categories of RNG creation: “passive” production, in which gas is systematically collected from naturally occurring biological processes, and “active” production, in which chemical reactions are engineered to produce gas from consistent feedstocks. Passive collection is typically some form of anaerobic decomposition or anaerobic digestion (AD), which typically occurs in wastewater resource recovery facilities (WRRFs), dairy farm digesters, food waste digesters, or landfills. Today’s leading methods of active gas production are pyrolysis (typically with biomass) and electrolysis (i.e. “power-to-gas”). The following diagram breaks down these categories.

With the exception of landfills, a shockingly small amount of domestic RNG production capacity is currently utilized. There are about 266 dairy farms in the US that use AD for manure management, comprising less than 1% of total US dairy farms. Meanwhile, just 7.5% of WRRFs host AD facilities, a nontrivial minority of which simply flare off the resulting biogas to avoid methane emissions while only 2% upgrade their biogas into RNG, largely due to high capital costs and insufficient incentives. The remainder generate electricity or run boilers with non-upgraded biogas, which is still mostly methane but with some CO2 and other impurities.

Boston Harbor’s Deer Island Wastewater Treatment Plant consists of 12 egg-shaped digesters, which process roughly 360 million gallons of wastewater per day. The system generates roughly 25% of its own energy needs. (Source: BioCycle)

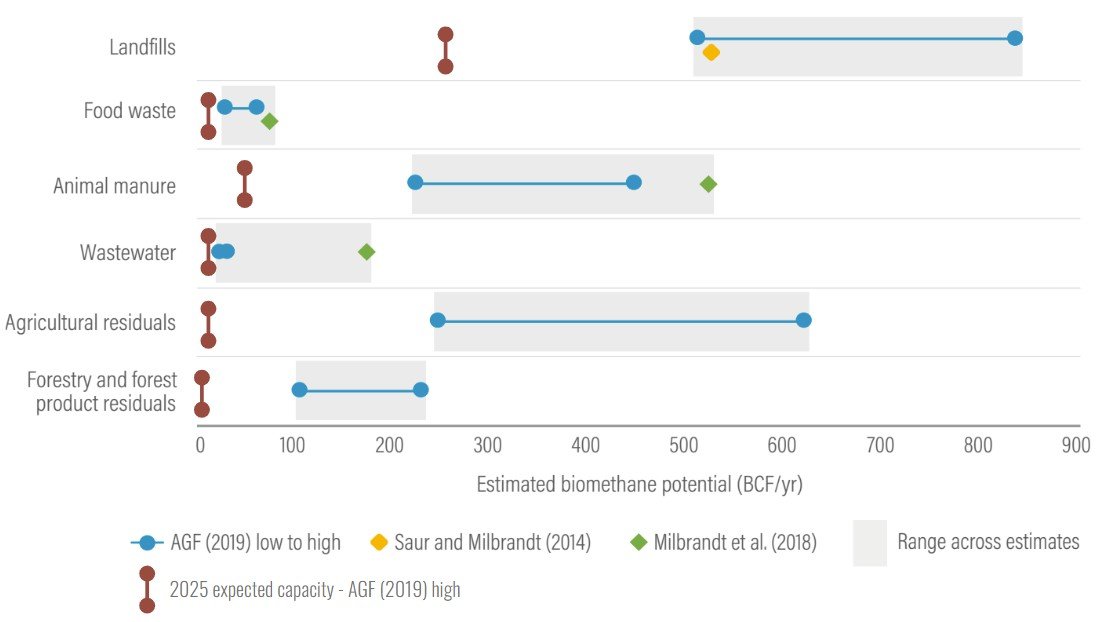

As for landfills, based on the EPA’s Landfill Methane Outreach Program (LMOP) Landfill and Project Database, there are roughly 500 US landfills with gas collection projects, along with about 75 projects planned or under construction. This represents only about half of EPA-identified candidate landfills (and as we’ll discuss later, this is some of the financial low-hanging fruit). The figure below quantifies the near-term and future RNG potential that could be produced in the US from each source, estimated in billion cubic feet (BCF) per year – along with where production stands today, shown in red. Clearly each category has plenty of room for expansion!

RNG Production Capacity by Feedstock Type (adapted from World Resources Institute)

Some key relationships between the generation methods are worth exploring in more detail. For example, if more states pass laws preventing food waste from being landfilled like Massachusetts, that would shift capacity from landfill RNG to food waste AD (and improve decarbonization potential, as food waste digesters tend to capture twice as much gas as landfills per ton of food). There are also hundreds of AD plants (and growing) that process multiple types of feedstocks together (e.g. manure and food waste), referred to as “co-digestion”.

In 2018, the US Department of Energy estimated that landfills, food waste, animal manure, and wastewater (“wet-waste feedstocks”) comprise a combined potential capacity of about 1,300 BCF per year, equal to just 7% of 2020 US natural gas consumption. Other estimates are similar; in 2019, the American Gas Foundation (AGF) estimated that 780 to 1,400 BCF per year could be made available by 2040 from wet-waste feedstocks, equating to just 4-8% of 2020 consumption.

In other words, if we max out our RNG generation capacity from all current passive production sources, we will still need to 10x that production capacity simply to meet a majority of US natural gas demand.

We should note, as do our friends at Energy Capital Ventures in a recent blog post, that there is a wide variation in estimates of RNG production capacity; however, what nearly all studies agree on is that we are currently producing a low single-digit percentage of the RNG that we are capable of.

So what about active gas production?

First, pyrolysis: The AGF estimates that pyrolysis of dry feedstocks, specifically agriculture and forestry residues, has a potential capacity of about 1,100 to 2,200 BCF, which could meet another 6-12% of US natural gas demand. Still, even if all of this capacity is captured, that still leaves ~80% of our current gas demand to be met by power-to-gas (P2G).

This result is worth repeating: if we want to serve all of today’s natural gas demand with renewable natural gas, at least 80% of it will have to be produced using electricity as the feedstock.

This is especially daunting when we consider that today natural gas is responsible for 3x as much energy consumption as all renewables generate combined, and the fact that roughly one-third of gas is already used for electricity production. Switching that equation requires us to more than 10X our renewable electricity generation – which does not include the extra renewables we’ll need for displacing coal and serving new loads such as EVs.

The good news is that the US has functionally limitless production capacity for P2G as the electrolysis and methanation processes can be powered by renewables like solar and wind. In this case the gas and electricity grids become even more intertwined, converting into each other in times of need to serve periods of high demand (and to avoid periods of oversupply).

The bad news is that end-to-end P2G technology is still somewhat nascent, and success stories are still few:

In 2014, SoCalGas and NREL developed the first US-based P2G project, a bioreactor located in California.

In 2016, SoCalGas and the University of California-Irvine announced the first successful US proof of concept for P2G, producing hydrogen gas using excess renewable energy.

Enbridge’s Markham Energy Storage Project, the first utility-scale P2G facility in North America, was established in Ontario in 2018.

Meanwhile, larger P2G projects are under development in Germany, but what remains to be seen is what limitations will surface as P2G looks to scale – e.g. land constraints, grid constraints, and economic constraints.

RNG is just one potential use for H2 produced via electrolysis (Source: POWER Magazine)

Scalability

Clearly we need to radically scale up RNG using all known available passive AND active production methods if we want to serve even a majority of current gas demand. How difficult will this be?

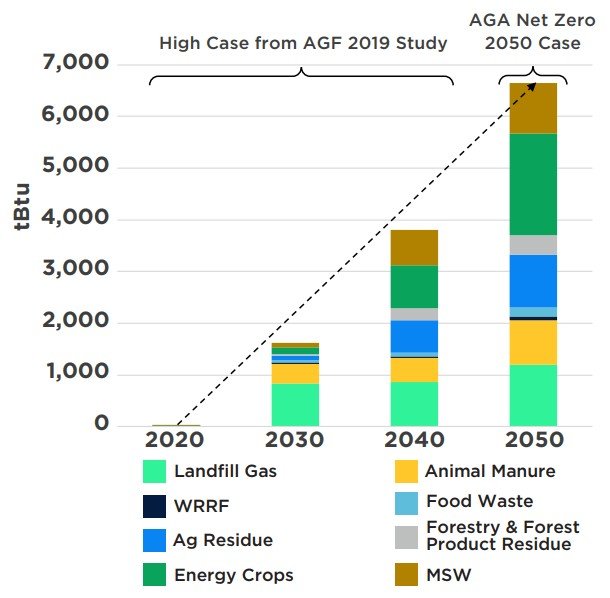

The American Gas Association (AGA) has included RNG as a prime emissions reduction opportunity pathway in its plan for reaching net zero emissions by 2050. The results of this modeling effort are presented in the figure below, assuming aggressive RNG adoption is made possible by the use of a higher proportion of available feedstocks.

RNG Production for Net Zero Gas by 2050 (Source: AGA)

From a business perspective, some key barriers must be addressed before we truly scale up our RNG production capacity, including feedstock availability, capital costs and policy/market risks.

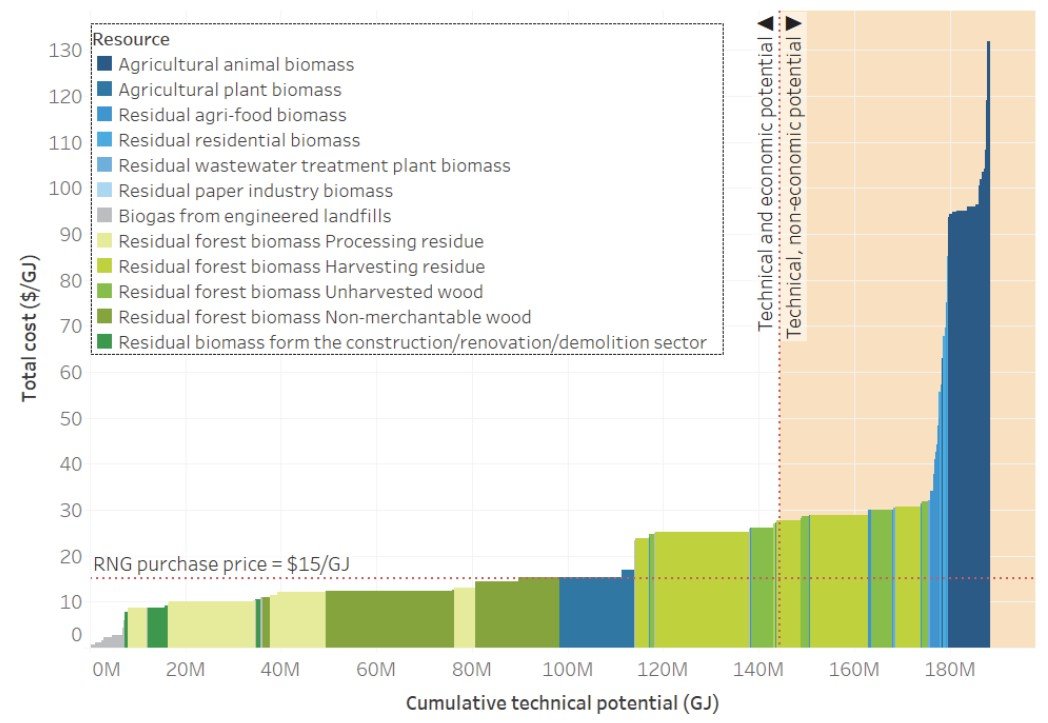

For example, upgrading biogas to pipeline-quality RNG remains expensive and can cost anywhere from $7 to $25 per MMBTU (note that 1 MMBTU ~ 1.05 GJ). A techno-economic analysis of RNG sources is shown in the figure below. Dry feedstocks (in green) largely correspond to active gas creation methods. Pyrolysis and P2G are nascent technologies, and thus are currently relatively expensive (yet note how lucrative landfill projects can be!).

Of course, if the natural gas price climb sustains, more and more projects will pencil, and we should expect this in the long run for any finite resource… but ultimately investments will depend on the price expectations agreed upon by gas utilities, project developers and investors over a 10- to 20-year time horizon (and the inherent biases affecting them).

2030 Techno-economic RNG Cost Curve (Source: Energir)

On the utility side, it’s worth noting that very little RNG is injected into pipeline grids today – note that the high end of the biogas upgrade cost range (up to $24 per GJ) can exceed the $15 RNG purchase price noted in this figure. Instead, biogas is typically combusted onsite to produce electricity, or sometimes (but increasingly) used as a transportation fuel. Therefore, to transition to a higher-RNG pipeline grid, gas utilities will also need more robust systems for compressing, blending and flow management.

Finally, from a biological perspective, since hydrogen (H2) requires CO2 to form methane (CH4), P2G electrolysis will need to be fed with abundant CO2 waste streams. Where will all this CO2 come from if we phase out coal and fossil gas? Could carbon capture, utilization and storage (CCUS) serve this need, and at what level? (Food for thought, or perhaps a future blog post!)

Enter climate tech's third law: you can't scale without policy enablement

“Least cost procurement” requirements implemented in states like Rhode Island seek to protect consumers by mandating gas utilities to procure only the cheapest gas they can while maintaining reliable service. Policies like this remain just one source of resistance along the RNG cost curve, limiting RNG technology providers by making it difficult to pencil capital-intensive projects with healthy IRR requirements.

One growing opportunity: monetizing the environmental benefits of RNG using tools like M-RETS can reduce such barriers as least cost procurement mandates. But the extent to which state public regulatory commissions should protect consumer-borne costs, at the expense of RNG project viability, remains an interesting debate (and we invite you to have it with us!).

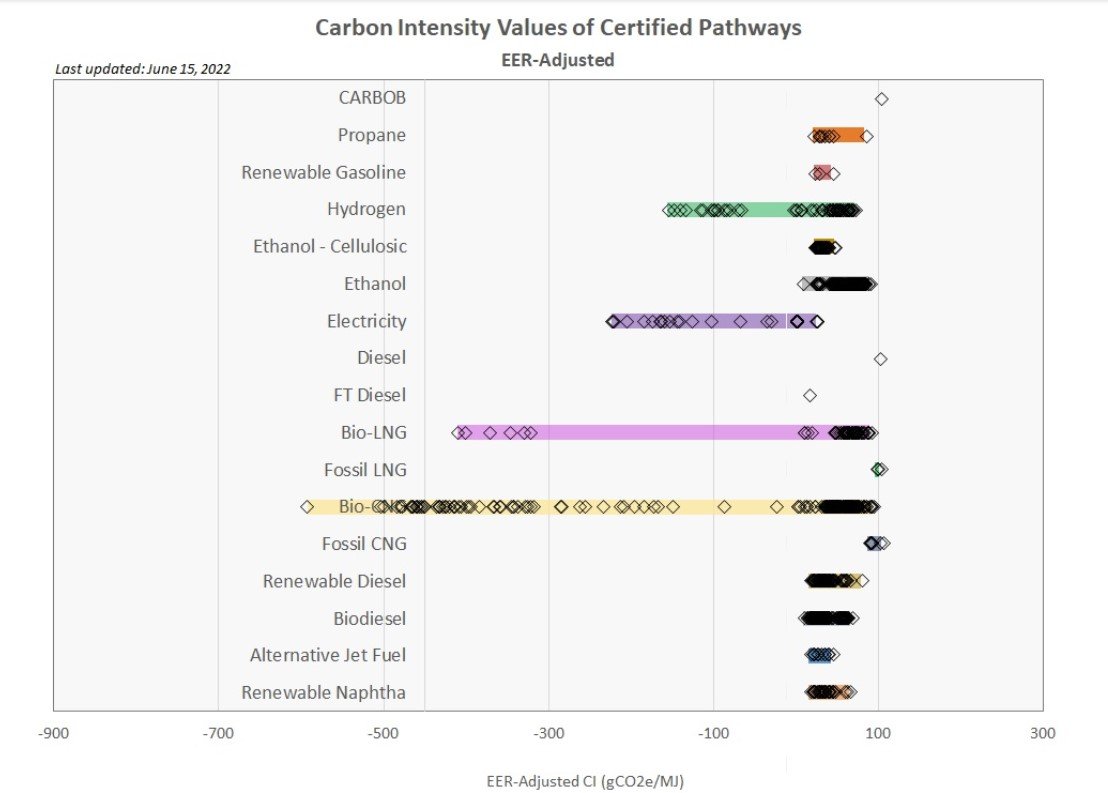

Meanwhile, on the opposite coast, California implemented a Low Carbon Fuel Standard (LCFS) program in 2011 to promote and regulate the use of low-carbon fuels for transportation. Under these rules, each type of transportation fuel is assigned a “carbon intensity” (CI) score. The CI scores are compared to a benchmark, which gradually declines every year (creating an increasingly lower-carbon “standard”). The use of fuels below this benchmark generates credits, while the use of fuels above the benchmark generates deficits. Transportation fuel providers are required to provide an overall mix of fuels that meets the standard, either directly or by purchasing credits from other providers.

The following graphs demonstrate how much Bio-LNG (liquified RNG) and Bio-CNG (compressed RNG) beat out other fuels in carbon intensity.

Carbon Intensity comparison across fuels (Source: CARB)

Today, even projects outside of California can leverage LCFS credits for fuel production, as long as their gas is connected to California’s gas system; the fuels must be consumed in California, but can be produced anywhere, and some estimate that 75% of LCFS fuels are produced outside of California.

LCFS, M-RETS and similar initiatives are stimulating methods of monetizing the environmental attributes of cleaner fuels. This greatly increases the chances that they are adopted, despite systemic inertia and policies like least-cost procurement rules. Isolated programs are unlikely to stimulate a nationwide movement toward RNG; fortunately, other states (and countries) have since proposed or adopted similar programs, including the Oregon Clean Fuels Program, which launched in 2016.

Closing remarks

Clearly, we in the US have plenty of room to scale up our RNG production efforts of all kinds, with many opportunities such as landfill gas collection already profitable with today’s technologies. What we need today is more inter-industry mobilization to design, finance and deploy these projects in a way that minimizes upgrades required on the gas grid and ultimately costs to gas ratepayers.

Any discussion of RNG is incomplete without mentioning that gas leaks can negate the climate benefits of RNG production. Methane’s greenhouse potential is up to 85 times more powerful than CO2 over a 20-year timescale, and a study published in 2018 found that a methane leakage rate of approximately 3% or higher would make natural gas from biogenic sources no better than fossil gas from an emissions perspective. As such, gas leak detection and repair (LDAR) is a required component of a net-zero gas future. Check out ADL’s blog post on deploying innovations to detect these leaks here.

Moreover, unlike conventional natural gas, livestock manure, food waste and wastewater represent cyclical and perpetual feedstocks that otherwise produce methane emissions in the absence of capture and combustion. Creating the economic conditions to make capturing this waste methane profitable should be universally supported, regardless of the scale.

As decarbonization goals and plans gather steam across economies, it’s hard not to ponder the pie-in-the-sky actions that public officials and gas utilities can take today to encourage the economic value and scalability of RNG production. Carbon tax? Political non-starter. Pricing environmental externalities into all fuel prices? Only on the West Coast. Tight methane emissions standards for landfills, WRRFs, dairy farms, and gas pipelines? Maybe someday. What we know for sure is that RNG production is woefully underutilized, and yet our primary feedstock helping to meet nationwide gas demand in the hopefully-near-future may actually be electricity – not food waste or manure.