Smarter Siting: Optimizing the Location of New Distributed Energy Resources

Developing and sharing digital tools that help optimize the location of new distributed energy resources (DERs) will allow utilities and developers to minimize the need for upgrades to transmission and distribution (T&D) infrastructure. Being strategic about where we site DERs — and empowering developers with the data to make those assessments at the start of their planning process — can decrease wait times in the interconnection queue, convert a greater percentage of proposals into completed sources of generation, and clean the grid for less.

Here’s a statistic to make you hopeful and frustrated at the same time: More than 60 percent of the renewable generation capacity needed to achieve 90 percent carbon-free electricity in the U.S. by 2035 is already sitting in transmission queues.

When it comes to proposed renewables projects, we are on our way to building the capacity required for cleaning the electric grid: according to a UC-Berkeley report, in a 90 percent clean scenario, the US will need to add about 1,100 GW of new wind and solar generation by 2035. As of the end of 2020, 680 GW worth of zero-carbon electric generation projects — plus 200 GW of storage — was already in line seeking grid interconnection. (Note: Today’s national solar capacity sits just over 100 GW, and wind capacity is just over 120 GW.)

Unfortunately, 21st century interconnection queue patterns suggest that only about a quarter of these proposed projects will ultimately reach operation: LBNL finds that completion rates have been even lower for wind (19%) and solar (16%).

LBL’s published list of projects waiting in line highlights a need for improvements to the interconnection process (note the amount of solar waiting for approval in MISO & PJM, and offshore wind in NYISO). Even if project execution rates never reach 100%, why not work to convert every proposed renewable generation resource into actual clean power flowing into homes, businesses, and factories as soon as possible?

As it turns out, it’s not that simple. Just like water pipes can only transport so much water, power lines are only designed to transport so much power. Infrastructure — including lines, transformers, substations, poles, etc. — needs to be upgraded to handle new levels of power flows.

Unfortunately, the process of building new transmission and distribution assets can be costly and slow — and it’s a big reason the interconnection queue is so backlogged today. Although some investments will be necessary, developing and sharing tools that help optimize the location of new clean resources will allow utilities and developers to minimize the need for upgrades to transmission and distribution (T&D) infrastructure, reducing the associated costs that utilities bear and rate-paying consumers ultimately fund.

We all should pay for some level of re-gridding; the challenge becomes minimizing those costs by siting new resources intelligently, to minimize costs for project developers and, subsequently, their customers. If DER developers knew where it would cause the smallest headache to build projects, wouldn’t they factor that into project siting? In other words, if developers could estimate interconnection delay and costs before even applying for approval from the utility, wouldn’t they seek the lowest-cost locations — and refrain from even applying for ultimately-cost-prohibitive interconnection?

Being strategic about where we site DERs — and empowering developers with the data to make those assessments at the start of their planning process — can decrease wait times in the queue, convert a greater percentage of proposals into completed sources of generation, and clean the grid faster and at a lower cost. An improved interconnection process built around developer-friendly application tools, data transparency, and digital modeling will facilitate smart siting.

How Interconnection Works

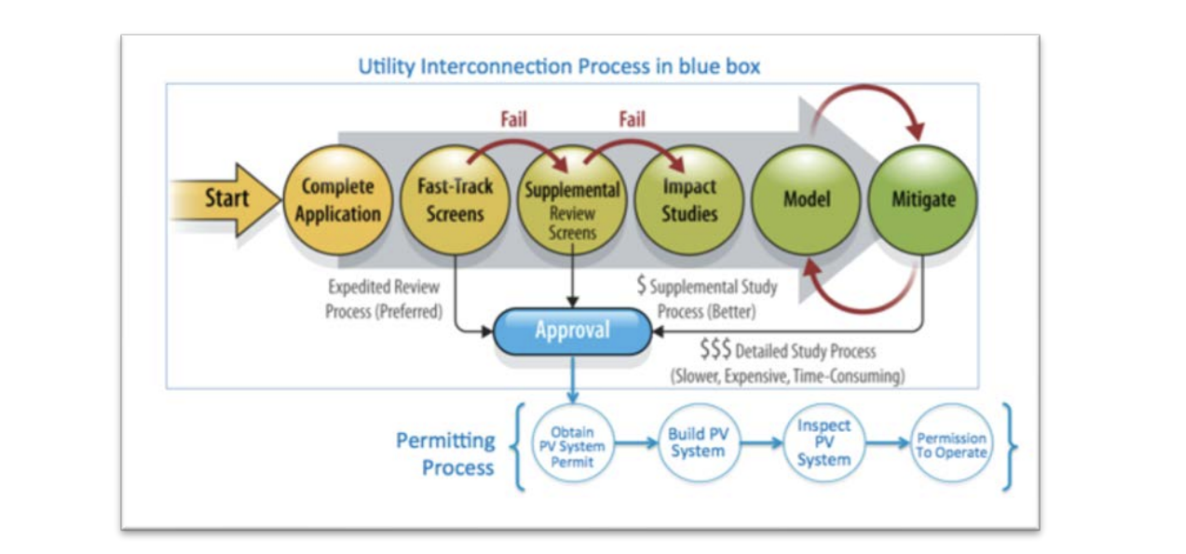

Typically, the interconnection process involves an initial application and a series of technical screens and studies that utilities undertake to assess the impact of adding any given project to the grid. Utility protection engineers will assess factors like distribution feeder fault detection and anti-islanding protection during the screening process. If studies uncover adverse effects on voltage, power quality, or protection that might occur with the addition of a DER at a specific point of interconnection, utilities then develop strategies for avoiding those consequences. Distribution system upgrades are one option, in which case upgrades need to be made before developers receive a permit to begin building their system.

Finally, once any necessary grid upgrades are complete and construction of the DER has been completed, projects undergo a final inspection. Developers ultimately receive permission to operate, at which point their energy resource can go live on the grid.

The Problem: An Interconnection Backlog

Grievances about the interconnection process are by no means new. When the U.S. DOE hosted a meeting in 1998 to discuss distributed generation, customers, vendors, and DER developers reported several barriers including technical issues (equipment and custom engineering analyses), institutional practices (contractual and procedural requirements), and regulatory issues (tariff structures like standby charges). When NREL examined 65 interconnection case studies for a report back in 2000, only seven cases involved no major barriers and timely project completion. The interconnection process was so cumbersome that several cases investigated by NREL involved utilities offering lower electric rates to project proponents in exchange for not building distributed generation.

The grid interconnection process has advanced significantly over the last two decades — average wait times for PTO notices can be as short as a week for some power providers — but requests to add new sources of energy generation to the grid have also surged, leading to more delays for interconnection projects. For projects built between 2000 and 2009, it took about 1.9 years to go from connection request to commercial operation. That duration increased to 3.5 for projects between 2010 and 2020, according to a May 2021 report from the LBNL.

Something needs to change here, and cost of inaction is high: a January 2021 report focusing on the eastern half of the U.S. estimated that “a comprehensive approach” to connecting remote sources of power generation to areas with high load could cut electric bills by $100 billion, decreasing the average bill by a third by 2050 — not to mention the carbon savings at hand.

Smart Siting

By avoiding grid upgrades and their associated costs, strategically locating new resources also prevents delays tied to cost allocation. If interconnection requires distribution system upgrades, costs are typically allocated to the developer of the project that triggers the upgrade. According to this participant funding structure, the costs of network upgrades are assigned to the interconnection customer, even in cases where upgrades would resolve general congestion on the transmission system or offer benefits to other or future developers. Such policies are a key reason interconnection proposals sit in the queue so long, but optimized siting could greatly alleviate this protracted interconnection study and cost allocation process.

Even FERC seems to agree reform is necessary as the interconnection landscape evolves; a July 2021 FERC Federal Register filing noted that uneven cost assignment has created incentives for developers to submit multiple “speculative” interconnection requests hoping for a favorable spot in the queue that forces another developer to bear upgrade costs. In other words, developers are trying to game the system, thereby creating longer wait times (and more work for utility engineers).

Yet, building new generation near congested T&D infrastructure or overloaded transformers, for example, can help alleviate local grid problems and even defer utility investments to accommodate new sources of load. EPRI conducted technical analyses for ConEd and SoCalEdison on how adding DERs would affect the need for grid expenditures; in one ConEd case study, EPRI found that targeted placement of DERs could resolve local reliability violations due to load growth. A later Analysis Group paper based on the study concluded that utilities should actually be integrating DERs into distribution planning.

Data Access and Transparency

When NREL conducted a study of interconnection practices and costs in Western states in 2018, the leading barrier they identified in interviews with developers was lack of information about the grid. Developers often struggle to collect information on grid conditions at specific locations, making it difficult for them to select and vet locations for proposed interconnection projects. Costs for upgrades vary but can be significant — NREL’s report on Western states found that total upgrade costs per utility impact study ranged from $23,000 to $19.7 million with a median cost of $306,000 — costs which are seldom known before a developer puts in the work just to get a project application-ready.

Data transparency and digital modeling could help guide decisions around siting DERs. For its ConEd analysis, EPRI used an allocation algorithm that mapped which specific load nodes were best suited to accommodate new DERs to relieve grid congestion. A proliferation of online databases that offer detailed, user-friendly maps and hosting capacity information — which some utilities like ConEd, XCel and Eversource already publicize — also help developers identify the most suitable locations in their territories.

A culture of information sharing and data access can lead the way, though utilities and regulators should also make efforts to maintain grid safety and security. In a recent blog post, Exelon’s former Manager of Corporate Strategy Jake Jurewicz advances the vision of a unified platform where all stakeholders assess DER proposals using the same representative data model of the utility region — “an independent arbiter of truth to help communities make the most capital efficient investment decisions.”

Eversource’s hosting capacity map of Greater Boston (red = congested)

Advancing Localized Planning and Grid Analytics

In Hawaii, the Pathways to an Open Grid project is seeking to produce “a digital, transparent, and smart map” of Oahu’s electric grid. Specifically, the project hopes to identify DERs’ locational value, or the degree to which a given resource increases or decreases costs based on its point of interconnection. The effort entails a collaboration between the Hawai’i Natural Energy Institute (HNEI), nonprofit Gridworks, incubator Elemental Excelerator, and Kevala, an energy data and analytics provider. Perhaps other utility regions can adopt these blueprints to create similarly cooperative interconnection task forces across the US.

Kevala is by no means a lone wolf; other platforms such as GridUnity and OpusOne Solutions are rising to meet the moment and are poised to help. But, given the interconnection quagmire, this can’t be fully solved without the cooperation and collaboration with local and regional utilities.

Example of an OpusOne Solutions street-level grid map

It’s clear that decarbonizing our electric grid will require significant additions of emissions-free generation capacity, but delays in the interconnection process are costing customers, utilities, and unnecessarily slowing the energy transition. Bringing together academics, nonprofits, utilities, regulators, developers and software providers at the same table will advance our ability to optimize the siting of DERs and clean the grid.

ADL Ventures can help too. Our firm’s experience supporting utilities resolve challenges on the grid, like modeling how to meet substation load with teams of generation technologies, has equipped us to help facilitate grid modernization. If you’re exploring how to deploy the processes and tools necessary for optimizing DER interconnection, reach out below.