Electric Vehicles: Cost Savings Perspective

Author: Conor Larkin and Ben Silton

Comprising over a quarter of annual emissions, the transportation sector is the largest contributor to greenhouse gas emissions in the United States. Of that quarter, light-duty vehicles account for 59%, meaning that consumer vehicles are responsible for more than an eighth of our entire carbon footprint. And yet, electric vehicles (EVs) made up less than 1% of all 46 million new light-duty vehicle sales in the US between 2011 and 2019. In their insights report on EV global sales, Deloitte projected that EVs would secure approximately 32 percent of the total market share for new car sales by 2030.

As these numbers are expected to increase over the coming decade, an examination of which states might offer the best opportunities for EVs reveals how the transition could play out in the United States. In this article, we examine fuel cost savings, current incentives, lifetime savings, and EV charging infrastructure to outline which states are best positioned for rapid EV adoption – with a special eye towards inconsistencies and opportunities.

Fuel Cost Savings

The difference in fuel cost between an EV and Internal Combustion Engine (ICE) vehicle driving 10,000 miles differs across states depending on gasoline and electricity prices. The states with the highest electricity fuel cost savings are Washington, North Carolina, Utah, California, and Oregon.

Nationwide EV Fuel Savings

The Pacific Northwest boasts one of the most significant cost advantages for electricity over gasoline. In Oregon, the fuel cost savings per 10,000 miles is $777, while in Washington (with its abundant cheap hydroelectricity) that number climbs to $864. On the other end of the spectrum, states with high electricity costs like Massachusetts and Rhode Island offer annual fuel savings of just $392 and $379 respectively due to relatively high electricity prices (i.e. high cost of charging) compared to gasoline prices.

Of course, an individual’s actual savings depends on their gas mileage before they switch, and the payback story gets murky when we bring hybrids and Plug-in Hybrids (PHEVs) into the mix. In 2019, scientists at the U.S. Department of Energy’s National Renewable Energy Laboratory (NREL) and Idaho National Laboratory released a comprehensive study examining the lifetime fuel cost savings of EVs in the US. The study estimated a national average of 15 year fuel cost savings at $7,758 for light-duty EVs and $7,317 for light-duty PHEVs compared to ICE vehicles. If you’re the type who wants an EV but is worried about range, perhaps you should consider a PHEV!

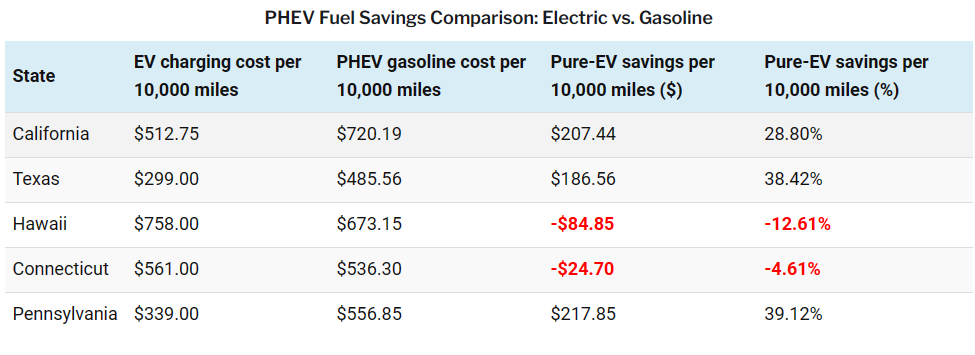

Slicing this comparison state-by-state once more indicates a varying payback story; in states with high gasoline prices AND disproportionately high electricity prices, like Hawaii and Connecticut, it actually makes more financial sense to switch to a PHEV than to an EV. The following table demonstrates this principle across a few key states.

Incentive Structures

EVs and PHEVs offer improved fuel savings over ICEs, but when consumers consider going electric, such savings might not always overrule the high upfront costs, lack of charging infrastructure and range anxiety, and consumer’s hesitancy to change, especially in states with low gasoline prices. The average American consumer, according to St. Louis Car dealer Brad Sowers in a recent Wall Street Journal article, “just isn’t there yet”.

In the face of this consumer uptake barrier, wise EV companies should leverage incentive programs that reduce the switching cost for EVs and PHEVs. The incentive landscape is ever changing and at times difficult to navigate, but it does indicate tremendous opportunities.

States across the country are offering unique incentives related to EVs, PHEVs, and charging infrastructure as the call to reduce emissions from the transportation sector revs up.

California’s Clean Vehicle Rebate Project offers up to $7,000 for the purchase or lease of a new zero-emission light-duty vehicle and $1,000 for a new PHEV. Colorado’s Innovative Motor Vehicle and Truck Credit offers $2,500 in tax credits for the purchase of a light duty EV or PHEV. Charge Ready New York offers rebates of $4,000 for installing a level 2 charging port. And the Utah Clean Diesel Program offers a grant to cover 45% of the cost to switch out class 5-8 diesel vehicles for all electric alternatives.

Lifetime Savings

A 2020 Consumer Reports study found that owning an EV instead of an ICE vehicle will save the typical driver $6,000 to $10,000 over the life of the vehicle. This analysis took into account upfront cost (including incentives), fuel costs and operating and maintenance costs (e.g. oil changes) to give a more holistic cost perspective. The following graph from the Consumer Reports study illustrates the lifetime savings for top selling EVs and PHEVs compared with the best-selling ICE vehicles in their class.

Lifetime Savings for Top Selling EVs

Source: Harto 2020, Consumer Reports

The study also found that the relative cost savings of a used EV purchased at 5-7 years old can be 2-3X as a result of lower operation and maintenance costs. As the transition away from ICE vehicles matures, therefore, we should expect very strong demand for used EVs – but that future market will be limited by today’s new EV sales, which are limited for several reasons including charging infrastructure as we examine next.

State Charging Infrastructure

Cross-referencing our fuel cost savings calculations with a recent report on EV chargers conducted by Elektrek reveals that certain states with high EV savings potential still lack the charging infrastructure needed to support the transition to EVs. For example, although North Carolina boasts the second highest EV fuel cost savings in the country, it is ranked just 23rd in the nation for charging outlets per 100k vehicles. In other words, North Carolina’s price incentives are strong, but its charging infrastructure is relatively sparse – so we may expect North Carolina to be a strong market for private (i.e. home) EV chargers. Similarly, the Pacific Northwest (OR and WA) offers strong EV fuel savings potential, yet its charging infrastructure is still relatively underdeveloped (charging providers take note!).

The same can be said for Illinois, which ranks 10th in EV fuel cost savings in the nation at $692 per 10K miles but is just 28th for charging stations per 100k vehicles, and Pennsylvania, where EV drivers can save $663 due to some of the highest gas prices in the nation but it is just 30th in charging outlets per 100k vehicles.

One takeaway here: electric utilities in states like North Carolina, Illinois, and Pennsylvania are missing out on this prime opportunity to assist in the transition to EVs and increase consumer demand for electricity by working with other stakeholders to put more EV chargers in the ground. Utilities that educate their customers on the increased fuel savings and invest in infrastructure to support EV adoption could see major upside as the number of EV drivers rise in their states.

Interestingly, the five states with the least attractive EV fuel savings all rank within the top 15 for charging infrastructure. Vermont and Massachusetts, for example, are ranked first and third respectively for charging infrastructure (in part due to customer demand and relatively strong regulatory support) despite their relatively high electricity prices. Of course, there are different ways to slice these data – for example, Vermont may still have a relatively low number of EV chargers per road-mile, or Massachusetts may have a relatively low number of EV chargers per EV driver – but this disproportional infrastructure investment relative to EV fuel savings highlights the multidimensional structures that can incentivize EV growth in certain states.

Final Thoughts

Fuel and maintenance savings, incentives, and infrastructure will be the major enablers for increased adoption of EVs across the nation. The analysis we present here provides a mere snapshot into how states are positioned in each of those determinants for EV growth, but the next few years are sure to yield a rapidly shifting landscape given the hundreds of billions of dollars to be devoted to transportation electrification in Biden’s Infrastructure Plan.

If we are to limit global temperature rise to two degrees Celsius, according to University of Toronto researchers, cumulative U.S. vehicle emissions must be limited to 39 gigatons between 2019 and 2050. EVs are at the center of achieving this goal. In the logistical process of getting more EVs on the ground it will be important for stakeholders to consider how best to facilitate adoption. Understanding how incentive structures, fuel costs, and charging infrastructure are related – and where they are inconsistent – can help governments, utilities, investors, vehicle manufacturers, and consumers make more informed decisions about how they can take advantage of the EV transition.